Banks play a vital role in our lives, but how much do you know about these financial institutions?

While most people are familiar with the basic services banks offer, there’s much more to discover about their history, operations, and quirky facts.

In this article, we’ve compiled a list of over 151+ fascinating banking trivia facts that will surprise and entertain you.

From the origin of the word “bank” to the most expensive money ever created, these tidbits of information will give you a newfound appreciation for the banking world.

Get ready to impress your friends and family with your knowledge of these amusing and informative banking facts that span centuries and continents.

Fascinating Facts About Banking Trivia

Historical Banking Facts

1. What ancient civilization is credited with establishing the first banks?

A: Ancient Mesopotamia, with the first banks dating back around 2000 BCE.

2. Which ancient Greek city-state was known for its early banking practices?

A: Athens, where bankers operated from temples and accepted deposits.

3. What was the primary function of early banks in ancient times?

A: Early banks primarily facilitated grain loans and acted as money changers.

4. Which ancient civilization used clay tablets as receipts for deposits?

A: The Babylonians used clay tablets to record deposits and loans.

5. Which famous Italian family became prominent bankers during the Renaissance?

A: The Medici family, who established the Medici Bank in the 15th century.

6. In which century did the Knights Templar operate as early bankers?

A: The 12th century, when the Knights Templar provided financial services to pilgrims.

7. Which Italian city was known as the banking capital of medieval Europe?

A: Florence, home to powerful banking families like the Medici and Peruzzi.

8. What was the name of the first modern bank established in Sweden?

A: Sveriges Riksbank, founded in 1668 as the first central bank in the world.

9. Which act laid the foundation for the modern Federal Reserve System in the United States?

A: The Federal Reserve Act of 1913, which created the Federal Reserve System.

10. In what year was the Bank of England, the world’s second-oldest central bank, founded?

A: 1694, established to raise funds for the British government during wartime.

11. Which U.S. president signed the Banking Act of 1933, also known as the Glass-Steagall Act?

A: President Franklin D. Roosevelt, as part of his New Deal program.

12. What was the purpose of the Bretton Woods Agreement of 1944?

A: To establish a new international monetary system and create the World Bank and IMF.

13. Which ancient civilization used cowrie shells as a form of currency?

A: The Chinese, during the Shang Dynasty (1766-1154 BCE).

14. What was the name of the first paper currency used in ancient China?

A: “Flying money,” introduced during the Tang Dynasty (618-907 CE).

15. Which medieval European city was known for its annual trade fairs and banking services?

A: Champagne, France, where merchants and bankers gathered for trade fairs.

16. What was the name of the first public bank established in Venice?

A: Banco di Rialto was founded in 1587 to stabilize the Venetian banking system.

17. Which famous Scottish economist and philosopher wrote about the benefits of banking in his book “The Wealth of Nations”?

A: Adam Smith, who discussed the role of banks in supporting economic growth.

18. In what year was the first ATM (Automated Teller Machine) introduced?

A: 1967, by Barclays Bank in London, United Kingdom.

19. Which U.S. president signed the Gramm-Leach-Bliley Act, repealing parts of the Glass-Steagall Act?

A: President Bill Clinton, in 1999, allowed banks to engage in securities trading and insurance.

20. What was the name of the ancient Mesopotamian temple where early banking activities took place?

A: The Temple of Uruk, where priests acted as bankers and lenders.

21. Which medieval Italian city was home to the oldest continuously operating bank until its collapse in 1995?

A: Siena, where the Monte dei Paschi di Siena bank was founded in 1472.

22. What was the name of the first printed paper money used in Europe?

A: Banknotes, first issued by Stockholms Banco in Sweden in 1661.

23. Which U.S. founding father established the First Bank of the United States?

A: Alexander Hamilton, who served as the first Secretary of the Treasury.

24. In what year did the Medici Bank, one of the most powerful banks of the Renaissance, collapse?

A: 1494, due to a combination of factors, including political turmoil and bad loans.

25. Which act created the Federal Deposit Insurance Corporation (FDIC) in the United States?

A: The Banking Act of 1933, also known as the Glass-Steagall Act.

26. What was the primary purpose of the Hawala system, an ancient informal banking system that originated in the Middle East?

A: To facilitate long-distance trade and money transfers without the physical movement of money.

27. Which ancient Greek temple served as a depository for the city-state’s wealth and offered loans?

A: The Temple of Artemis in Ephesus, one of the Seven Wonders of the Ancient World.

28. What was the name of the first joint-stock bank established in England?

A: The Bank of England was founded in 1694 as a private bank to finance the British government.

29. Which Italian mathematician is credited with inventing double-entry bookkeeping, a fundamental concept in modern banking?

A: Luca Pacioli, who described the double-entry system in his book “Summa de Arithmetica” in 1494.

30. In what year did the Rothschild family establish their first international banking dynasty?

A: 1815, when the five Rothschild brothers opened banks in London, Paris, Frankfurt, Vienna, and Naples.

31. Which U.S. president signed the Emergency Banking Act of 1933, granting the government more control over the banking system?

A: President Franklin D. Roosevelt, as part of his first 100 days in office during the Great Depression.

Interesting Banking Facts Around the World

32. In Japan, what is the traditional gift given to children on New Year’s Day?

A: “Otoshidama,” small envelopes containing money, given by parents and relatives.

33. Which country is known for its numbered bank accounts that offer a high level of privacy?

A: Switzerland is famous for its banking secrecy laws, which have attracted wealthy clients worldwide.

34. What is the name of the world’s oldest bank still in operation?

A: Banca Monte dei Paschi di Siena, founded in 1472 in Siena, Italy.

35. Which country has a bank that offers a “wedding account” to help couples save for their big day?

A: South Korea, where the Woori Bank offers special wedding savings accounts.

36. What is the bank’s name inside the Vatican City?

A: The Institute for the Works of Religion, commonly known as the Vatican Bank.

37. Which country has a bank offering children a “chocolate account”?

A: Germany, where the Volksbank Weinheim offers a savings account with chocolate rewards for kids.

38. What is the name of the only bank located in Antarctica?

A: The Banco de la Nación Argentina, located in Argentina’s Esperanza Base research station.

39. Which country has a mobile banking service that operates on boats?

A: Bangladesh, where the “River Banks” provide financial services to remote villages along rivers.

40. What is the name of the bank in Timbuktu, Mali, that stores its reserves in an unusual form?

A: The Timbuktu Manuscript Bank, which stores its wealth in the form of ancient manuscripts.

41. Which country has a tradition of gifting money in red envelopes during the Lunar New Year?

A: China, where “hongbao” is given to children and unmarried adults as a symbol of good luck.

42. What is the name of the Dubai bank with a gold ATM?

A: The Emirates Palace Hotel houses an ATM dispensing gold bars and coins.

43. Which country has a bank that offers a “festival account” to help customers save for cultural celebrations?

A: India, where some banks offer special accounts to save for festivals like Diwali and Durga Puja.

44. What is the name of the Norwegian bank that operates inside a restored wooden church?

A: The Hegra Savings Bank, located in a former 12th-century church in Hegra, Norway.

45. Which country has a bank that offers a “farming account” specifically designed for agricultural businesses?

A: Australia, where the National Australia Bank offers specialized accounts for farmers.

46. What is the name of the bank in Brazil that has a soccer-themed credit card?

A: Banco do Brasil, which offers a credit card in partnership with the Brazilian Football Confederation.

47. Which country has a bank that provides a “happiness account” to encourage saving for experiences?

A: Canada, where TD Bank offers a savings account focused on saving for meaningful experiences.

48. What is the name of the Russian bank that has a branch inside a metro station?

A: Sberbank has a branch inside the Vystavochnaya metro station in Moscow.

49. Which country has a bank that offers a “gold certificate” as an alternative to physical gold ownership?

A: Singapore, where the United Overseas Bank offers gold certificates backed by physical gold.

50. What is the name of the South African bank with a “stokvel account” for community savings clubs?

A: The Standard Bank of South Africa offers accounts for stokvels and informal savings clubs.

51. Which country has a tradition of breaking ceramic piggy banks on New Year’s Eve?

A: Greece, where the custom of breaking a “karavaki” is believed to bring good luck and prosperity.

52. What is the name of the Kazakhstan bank with a branch inside a yurt?

A: Halyk Bank has a unique yurt-shaped branch in Almaty, Kazakhstan.

53. Which country has a bank that offers a “dowry account” to help families save for their daughters’ weddings?

A: Pakistan, where some banks offer special savings accounts for dowry purposes.

54. What is the name of the bank in Spain that has a branch inside a medieval castle?

A: CaixaBank has a branch inside the Castell de Cardona, a 9th-century castle in Catalonia.

55. Which country has a tradition of gifting money in small, decorative envelopes during weddings?

A: Japan, where “goshugi” envelopes containing money are given to the bride and groom.

56. What is the name of the bank in Turkey that has a branch inside a historic bathhouse?

A: Vakıfbank, which has a unique branch inside the 16th-century Çemberlitaş Hamamı in Istanbul.

57. Which country has a bank that offers a “foreign domestic worker account” for migrant workers?

A: Hong Kong, where HSBC offers special accounts for foreign domestic helpers.

58. What is the name of the bank in Iran that has a branch inside a historic caravanserai?

A: Bank Melli Iran has a branch inside the 17th-century Mahyar Caravanserai in Isfahan.

59. Which country has a tradition of gifting money in red and gold envelopes during the Vietnamese New Year?

A: Vietnam, where “lì xì” envelopes are given to children and elderly relatives for good luck.

60. What is the name of the bank in Egypt that has a branch inside the Giza Necropolis?

A: Banque du Caire has a branch near the famous Giza Pyramids.

61. Which country has a bank that offers a “monk account” for Buddhist temples and monasteries?

A: Thailand, where some banks provide special accounts for the financial needs of Buddhist institutions.

62. What is the name of the bank in Liechtenstein that has a branch inside a former princely residence?

A: LGT Bank has a branch inside Vaduz Castle, the official residence of the Prince of Liechtenstein.

Technological Advances in Banking

63. What technology enabled the transition from physical ledgers to digital records in banking?

A: Computerization, which allows banks to store and process financial data electronically.

64. In what year was the first mobile banking service launched?

A: 1999, when the Bank of Montreal introduced Canada’s first mobile banking service.

65. What technology name allows for secure, decentralized transactions without intermediaries?

A: Blockchain, which serves as the foundation for cryptocurrencies like Bitcoin.

66. Which bank introduced the first Internet banking service in the United States?

A: Wells Fargo, which launched its online banking platform in 1995.

67. What is the name of the technology that enables customers to make payments using their smartphones?

A: Near Field Communication (NFC) allows contactless payments through mobile devices.

68. Which bank introduced the banking industry’s first chatbot for customer service?

A: Bank of America, which launched its AI-powered chatbot named “Erica” in 2018.

69. What is the name of the technology that uses biometric data for user authentication in banking?

A: Biometric authentication, which includes fingerprint scanning, facial recognition, and voice recognition.

70. Which bank introduced the first video banking service, allowing customers to interact with bankers remotely?

A: Barclays, which launched its video banking service in 2014.

71. What is the name of the technology that automates repetitive tasks and processes in banking?

A: Robotic Process Automation (RPA), which streamlines operations and reduces manual errors.

72. Which bank introduced the first mobile app for smartwatches?

A: Banco Sabadell, which launched its smartwatch app for Apple Watch and Android Wear in 2015.

73. What is the name of the technology that uses machine learning algorithms to detect fraudulent transactions?

A: Fraud detection AI, which analyzes patterns and anomalies to identify potential fraud in real time.

74. Which bank introduced the first virtual reality (VR) banking experience?

A: Citi, which launched a VR banking platform for customers in 2016.

75. What is the name of the technology that enables customers to withdraw cash from ATMs using their smartphones?

A: Cardless ATM withdrawals allow customers to access funds without a physical debit card.

76. Which bank introduced the first voice-activated banking service using virtual assistants like Amazon Alexa?

A: Capital One, which launched its voice banking service in 2016.

77. What is the name of the technology that uses big data analytics to personalize banking services?

A: Personalized banking, which analyzes customer data to provide tailored recommendations and offers.

78. Which bank introduced the first augmented reality (AR) banking app?

A: HSBC launched an AR-enabled mobile app in 2017 to help customers locate nearby ATMs and branches.

79. What is the name of the technology that enables secure, instant payments between banks?

A: Real-time gross settlement (RTGS) allows for the immediate transfer of funds between financial institutions.

80. Which bank introduced the first banking service for wearable devices like smartwatches?

A: Bank of America, which launched its wearable banking app in 2015.

81. What is the name of the technology that uses artificial intelligence to provide personalized investment advice?

A: Robo-advisors, which offer automated, algorithm-based financial planning services.

82. Which bank introduced the first blockchain-based trade finance platform?

A: HSBC, which launched its blockchain-powered trade finance platform in 2018.

83. What is the name of the technology that enables secure, remote identity verification for banking services?

A: Digital identity verification uses biometric data and other factors to authenticate users online.

84. Which bank introduced the first mobile app for personal financial management?

A: Mint, which launched its mobile app in 2009 to help users track their spending and budgets.

85. What is the name of the technology that uses machine learning to provide predictive analytics for banking services?

A: Predictive analytics analyzes historical data to forecast customer behavior and market trends.

86. Which bank introduced the first mobile app for peer-to-peer payments?

A: Venmo, which launched its mobile payment app in 2009, allows users to send and receive money.

87. What is the name of the technology that uses natural language processing to provide customer support in banking?

A: Conversational AI, which enables human-like interactions between customers and virtual assistants.

88. Which bank introduced the first mobile app for business banking services?

A: JPMorgan Chase, which launched its mobile app for small business banking in 2011.

89. What is the name of the technology that uses quantum computing to optimize financial models and risk management?

A: Quantum finance, which applies quantum algorithms to complex financial problems for faster and more accurate solutions.

90. Which bank introduced the first mobile app for international money transfers?

A: TransferWise (now known as Wise), which launched its mobile app in 2015 for low-cost, transparent cross-border payments.

91. What is the name of the technology that uses smart contracts to automate financial transactions and agreements?

A: Blockchain-based smart contracts execute automatically when predefined conditions are met, reducing the need for intermediaries.

92. Which bank introduced the first mobile app for saving and investing spare change?

A: Acorns, which launched its mobile app in 2014, is rounding up users’ purchases and investing in spare change.

93. What is the name of the technology that uses biometric data to enable secure, contactless payments?

A: Biometric payments, which allow users to authenticate transactions using fingerprints, facial recognition, or other biometric factors.

Fun and Surprising Banking Facts

94. Which famous American actor once had his bank account frozen for suspected money laundering?

A: Johnny Depp, whose account was frozen by JP Morgan Chase in 2017 due to suspicious transactions.

95. What is the name of the bank robber who became famous for his polite demeanor during heists?

A: The “Gentleman Bank Robber,” Eddie Dodson, robbed over 60 banks in the 1980s.

96. Which celebrity had a bank account number that was only one digit long?

A: Oprah Winfrey had an account with Bank of America that was simply the number “1”.

97. What is the name of the bank that Butch Cassidy and the Sundance Kid robbed?

A: The San Miguel Valley Bank in Telluride, Colorado, was robbed by the notorious outlaws in 1889.

98. Which country’s law allowed banks to seize money from inactive accounts until 2013?

A: Switzerland, where banks could transfer funds from dormant accounts to their coffers after a certain period of inactivity.

99. What is the name of the bank that issued a credit card to a cat?

A: Tinkoff Bank in Russia issued a credit card to a cat named Kuzya in 2015 as part of a promotional campaign.

100. Which country’s law prohibited banks from charging interest on loans until 1985?

A: Iran, where Islamic banking principles forbid charging interest (riba) on loans.

101. What is the name of the bank that issued a credit card with a $1 million spending limit?

A: Dubai First, which offered the “Royale MasterCard” with a $1 million credit limit and no spending restrictions.

102. Which country has a law requiring banks to offer all citizens basic accounts, regardless of their financial status?

A: France, where the “droit au compte” (right to an account) law ensures access to basic banking services for all.

103. What is the name of the bank that issued a diamond-encrusted credit card?

A: Kazakhstan’s Eurasian Bank offered a Visa Infinite card with a diamond-encrusted gold design.

104. Which country had a law that allowed banks to refuse service to customers wearing pajamas?

A: In the United Kingdom, some banks have dress codes prohibiting customers from wearing sleepwear.

105. What is the name of the bank that issued a credit card made of pure gold?

A: The Royal Bank of Scotland offered a solid gold MasterCard for its wealthiest clients.

106. Which country has a law that requires banks to provide free ATM withdrawals to all customers?

A: Australia, where banks cannot charge customers for using their ATMs.

107. What is the name of the bank that issued a credit card with a built-in LCD screen and keypad?

A: Visa, which introduced the “Visa Code Card” with an LCD display and keypad for added security.

108. Which country had a law that allowed banks to charge customers for using debit cards until 2009?

A: The United States, where banks could charge merchants a fee for accepting debit card payments.

109. What is the name of the bank that issued a credit card with a built-in fingerprint scanner?

A: MasterCard, which introduced the “MasterCard Biometric Card” with an embedded fingerprint sensor.

110. Which country has a law that requires banks to offer services in both official languages?

A: Canada, where banks must provide services in both English and French to ensure accessibility.

111. What is the name of the bank that issued a credit card with a built-in dual-screen display?

A: EmiratesNBD, which introduced the “Bon Appétit Card” with two LCD screens for added functionality.

112. Which country had a law that prohibited banks from opening branches in grocery stores until 1999?

A: The United States, where banks were restricted from opening in-store branches due to anti-competitive concerns.

113. What is the name of the bank that issued a credit card with a built-in bottle opener?

A: Russia’s Tinkoff Bank, which offered a metal credit card with a built-in bottle opener as a unique feature.

114. Which country has a law that requires banks to contribute a portion of their profits to charitable causes?

A: India, where banks must allocate a percentage of their net profit to corporate social responsibility initiatives.

115. What is the name of the bank that issued a credit card with a built-in flashlight?

A: South Korea’s BNK Busan Bank, which offered a credit card with a built-in LED flashlight for convenience.

116. Which country had a law that allowed banks to charge customers for receiving paper statements until 2016?

A: The United Kingdom, where banks could charge a fee for providing paper statements instead of electronic ones.

117. What is the name of the bank that issued a credit card with a built-in thermometer?

A: China’s Yinchuan Commercial Bank introduced a credit card with an integrated thermometer for health monitoring.

118. Which country has a law that requires banks to offer free cash withdrawals from any bank’s ATM?

A: Sweden, where customers can withdraw cash from any ATM without fees, regardless of their bank.

119. What is the name of the bank that issued a credit card with a built-in compass?

A: Russia’s Rosselkhozbank, which offered a credit card with an integrated compass for outdoor enthusiasts.

120. Which country’s law prohibited banks from charging customers for using checks until 2010?

A: France, where banks were not allowed to charge fees for check usage as a means of payment.

121. What is the name of the bank that issued a credit card with a built-in altimeter?

A: Switzerland’s Cornèrcard, which introduced a credit card with an integrated altimeter for mountain sports enthusiasts.

122. Which country has a law that requires banks to offer basic savings accounts with no minimum balance?

A: Denmark, where banks must provide a basic savings account to all citizens without requiring a minimum deposit.

123. What is the name of the bank that issued a credit card with a built-in speedometer?

A: UAE’s Emirates Islamic Bank, which offered a credit card with a built-in digital speedometer for car enthusiasts.

124. Which country had a law that allowed banks to charge customers for using mobile banking apps until 2018?

A: Australia, where banks could charge fees for mobile banking services before regulatory changes.

Impact of Banking on Society

125. How do banks contribute to economic growth and development?

A: Banks provide credit and financial services that enable businesses to invest, expand, and create jobs.

126. What role do banks play in promoting financial stability?

A: Banks help maintain financial stability by managing risk, providing liquidity, and ensuring the smooth functioning of the payment system.

127. How do banks support community development initiatives?

A: Banks often invest in local communities through charitable donations, sponsorships, and financial education programs.

128. What is microfinance, and how does it benefit low-income individuals?

A: Microfinance provides small loans and financial services to underserved communities, helping them start businesses and improve their livelihoods.

129. How do banks contribute to the growth of small and medium-sized enterprises (SMEs)?

A: Banks offer specialized lending products, business accounts, and advisory services to support the growth and success of SMEs.

130. What is the role of banks in promoting financial inclusion?

A: Banks work to expand access to financial services for underbanked populations through initiatives like mobile banking and community outreach.

131. How do banks support the transition to a green economy?

A: Banks finance renewable energy projects, offer green bonds, and develop sustainability-focused investment products to promote environmental sustainability.

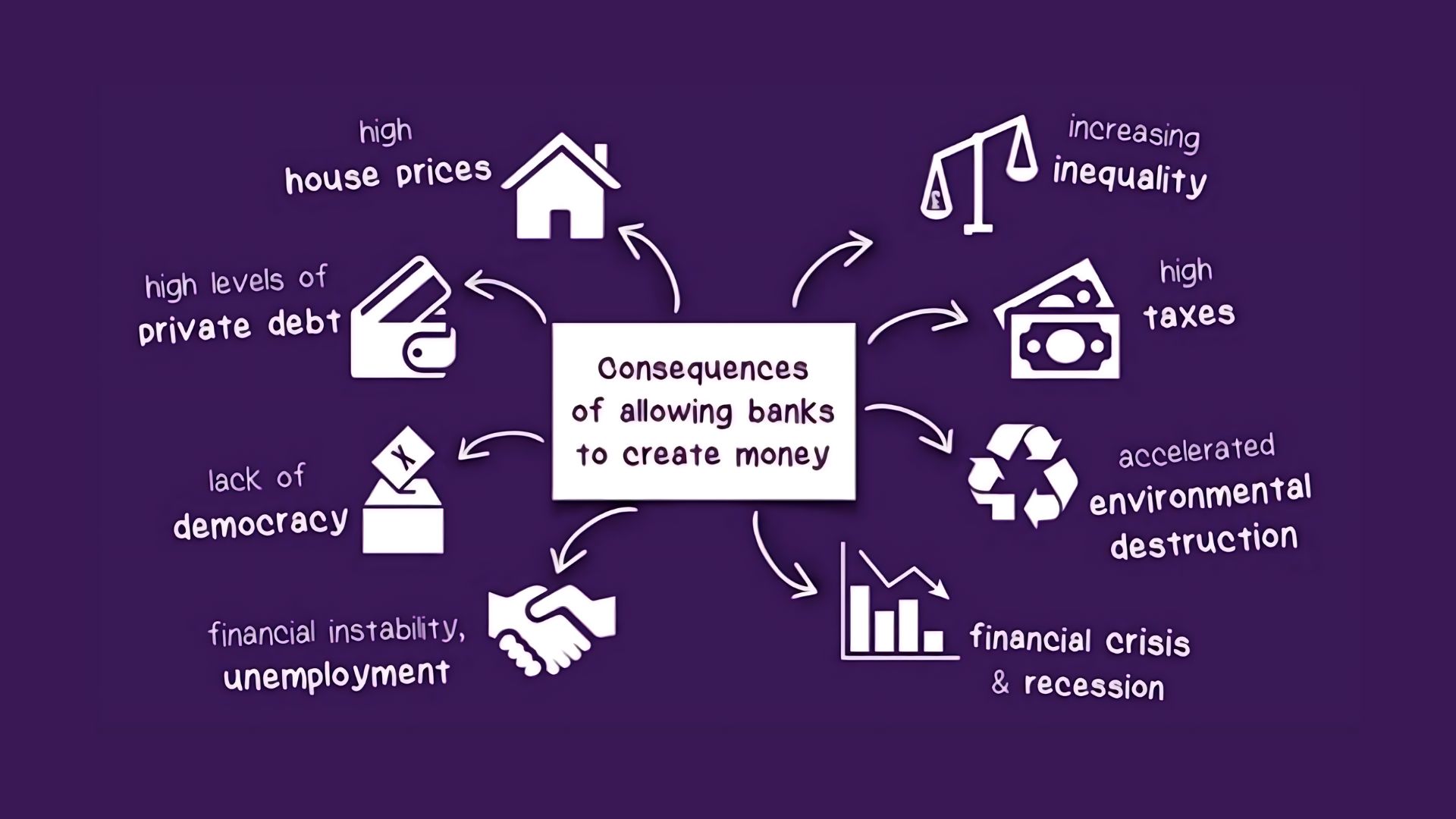

132. What is the impact of bank lending on housing affordability?

A: Banks play a crucial role in the housing market by providing mortgages, which can influence housing prices and affordability.

133. How do banks contribute to the development of infrastructure projects?

A: Banks provide financing for large-scale infrastructure projects like roads, bridges, and power plants, which support economic growth and development.

134. What is the role of banks in promoting financial literacy?

A: Banks often sponsor financial education programs, workshops, and resources to help individuals make informed financial decisions.

135. How do banks support the growth of the agricultural sector?

A: Banks offer specialized lending products, crop insurance, and advisory services to support farmers and agricultural businesses.

136. What is the impact of bank lending on student debt?

A: Banks provide student loans to help individuals finance their education, which can contribute to the overall student debt burden.

137. How do banks promote entrepreneurship and innovation?

A: Banks offer startup financing, business incubator programs, and partnerships with accelerators to support entrepreneurship and innovation.

138. What is the role of banks in facilitating international trade?

A: Banks provide trade finance services, such as letters of credit and export credit insurance, to support cross-border transactions and minimize risk.

139. How do banks contribute to the development of the tourism industry?

A: Banks finance hotel and resort projects, offer travel credit cards, and provide foreign exchange services to support the growth of the tourism sector.

140. What is the impact of bank lending on consumer debt?

A: Banks offer personal loans, credit cards, and other consumer lending products, which can contribute to household debt levels.

141. How do banks support the growth of the healthcare industry?

A: Banks provide financing for healthcare facilities, equipment, and research, as well as offer specialized banking services for healthcare providers.

142. What is the role of banks in promoting gender equality?

A: Banks implement gender-inclusive lending policies, support women-owned businesses, and promote diversity in their workforce and leadership.

143. How do banks contribute to the development of the technology sector?

A: Banks finance technology startups, invest in fintech innovations, and collaborate with tech companies to develop new financial products and services.

144. What is the impact of bank lending on income inequality?

A: Bank lending practices can influence income inequality by affecting access to credit, interest rates, and financial services for different socioeconomic groups.

145. How do banks support the growth of the renewable energy sector?

A: Banks provide financing for solar, wind, and other renewable energy projects, as well as offer specialized investment products focused on clean energy.

146. What is the role of banks in promoting sustainable supply chains?

A: Banks develop financing solutions and advisory services to help businesses adopt sustainable practices and manage environmental and social risks in their supply chains.

147. How do banks contribute to the development of smart cities?

A: Banks finance smart city initiatives, such as intelligent transportation systems and energy-efficient buildings, to support sustainable urban development.

148. What is the impact of bank lending on the real estate market?

A: Banks provide mortgages and construction loans, which can influence real estate prices, development trends, and urban planning decisions.

149. How do banks support the growth of the creative industries?

A: Banks offer specialized lending products and services for creative businesses, such as film production companies and design firms, to support the creative economy.

150. What is the role of banks in promoting financial security for seniors?

A: Banks offer retirement planning services, pension products, and specialized accounts for seniors to help them manage their finances and maintain financial security.

151. How do banks contribute to the development of rural communities?

A: Banks provide financing for agricultural projects, rural infrastructure, and community development initiatives to support economic growth and well-being in rural areas.

152. What is the impact of bank lending on the automotive industry?

A: Banks offer car loans and leasing options, which can influence consumer purchasing decisions and the growth of the automotive sector.

153. How do banks support the growth of the education sector?

A: Banks provide financing for educational institutions, student housing projects, and research facilities to support the development of the education sector.

154. What is the role of banks in promoting financial security for gig economy workers?

A: Banks develop specialized financial products and services, such as income smoothing and insurance, to support the financial well-being of gig economy workers.

155. How do banks contribute to the development of the circular economy?

A: Banks finance circular economy initiatives, such as waste reduction and recycling projects, and develop innovative financial products to support the transition to a more sustainable economic model.

Conclusion

Let’s wrap up this interesting journey through the world of banking trivia.

As we’ve discovered, the history of banking is filled with surprising facts, cultural quirks, and technological innovations that continue to transform the way we manage our money.

Whether you’re a financial enthusiast or simply curious about the world around you, these 151+ banking trivia questions have hopefully piqued your interest and expanded your knowledge.

So, what’s next? Keep exploring the world of finance, and don’t forget to share these fascinating facts with your friends and family.

Who knows, you might inspire the next generation of bankers and financial innovators!