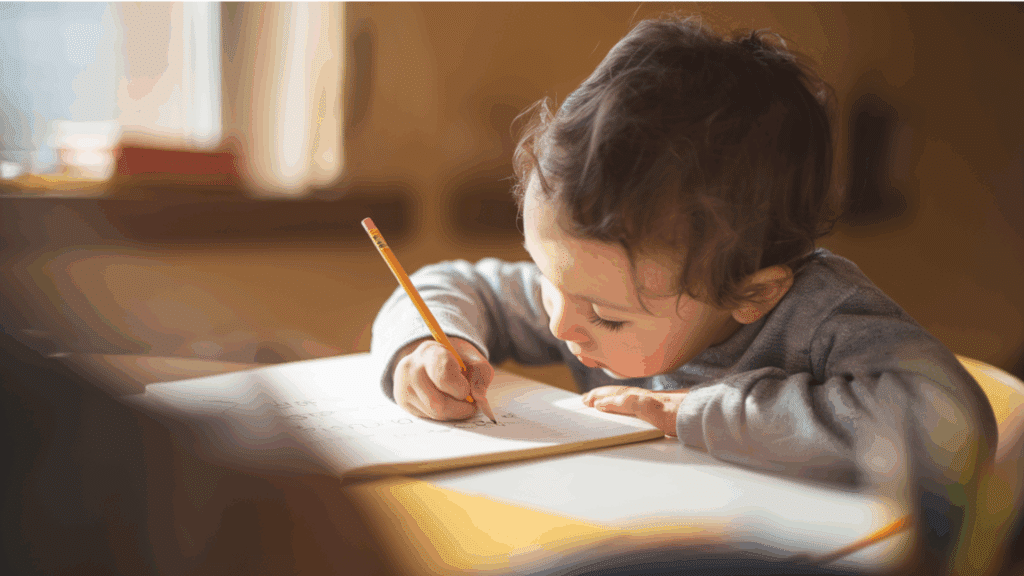

Money is an essential part of everyday life, yet financial literacy is rarely taught in schools at an early age. Parents who introduce their children to money concepts through fun, engaging activities set them up for long-term success. The good news? Teaching kids about money doesn’t have to be dull or complicated. Through interactive play and hands-on experiences, children can develop a healthy relationship with money while having fun with their families.

Why Teaching Kids About Money Matters

Children develop financial habits early, often before they even realize it. Studies show that money habits begin forming as young as age seven. Parents can help children understand spending, saving, and responsible decision-making from an early age by incorporating financial education into play. When kids see money as a tool rather than just something to spend, they gain valuable life skills that will serve them well into adulthood.

Fun Ways to Teach Kids About Money

Playing Store: The Basics of Buying and Selling

Setting up a pretend store at home is an easy and effective way to teach kids about transactions, budgeting, and value. Give children play money and let them “shop” for toys, books, or household items. Parents can take turns being the cashier and the customer to demonstrate how buying and selling work. This game helps kids grasp basic math skills, understand the difference between needs and wants, and learn the value of different items.

Board Games That Teach Money Skills

Many classic board games incorporate financial concepts in a way that makes learning feel like play. Games like Monopoly, The Game of Life, and Pay Day introduce kids to money management, strategic thinking, and risk assessment. By playing these games as a family, children naturally absorb lessons about saving, investing, and making smart financial choices.

Chore Charts and Earning Allowance

Teaching kids about earning money through work can be as simple as using a chore chart. Assigning value to tasks, such as cleaning their room or helping with the dishes, gives children a tangible understanding of how money is earned. Let them decide how to spend, save, or donate their earnings. This hands-on approach instills the concept of financial responsibility and goal setting.

Digital Tools: Teaching Modern Money Management

Using Debit Cards for Hands-On Learning

As digital transactions become the norm, introducing kids to debit cards can be a practical way to teach them about financial responsibility. Many banks offer prepaid or kid-friendly debit cards that parents can monitor. By loading a set allowance onto the card, children learn how to budget and track their spending through an app. This method also encourages discussions about security and responsible money habits. If a child misplaces their card, it becomes a learning opportunity to discuss what to do when dealing with a lost debit card and the importance of safeguarding financial information.

Savings Jars vs. Bank Accounts

For younger children, clear jars labeled “Spend,” “Save,” and “Give” provide a visual way to divide money into categories. As kids age, transitioning to a savings account helps reinforce long-term financial planning. Parents can encourage kids to set savings goals, such as buying a new toy or saving for a bigger purchase, to teach delayed gratification.

Real-Life Scenarios: Making Money Lessons Relevant

Grocery Shopping on a Budget

One of the easiest ways to teach kids about money is by involving them in grocery shopping. Give them a small budget and let them pick out items while comparing prices and making choices. This activity teaches the importance of sticking to a budget, prioritizing needs over wants, and making cost-effective decisions.

Planning a Family Outing

Another great way to teach financial planning is to let kids help plan a family outing with a set budget. Whether it’s a trip to the amusement park, a picnic, or a movie night, they can compare options, check prices, and make decisions that fit within the budget. This practical exercise fosters responsibility and critical thinking skills.

Encouraging a Healthy Money Mindset

Beyond play and activities, how parents talk about money influences how children perceive it. Open discussions about saving, spending wisely, and making informed financial choices help kids develop confidence in managing their finances. Encouraging questions and making learning about money a normal part of family life ensures children grow up financially savvy.

Additionally, parents can lead by example by demonstrating smart money habits in their everyday lives. Simple actions, like discussing a grocery list before shopping or setting aside money for savings in front of their kids, can reinforce positive financial behaviors. Children who see their parents budgeting and making informed financial decisions are more likely to adopt these habits themselves, setting them up for financial success in the future.

Conclusion

Teaching kids about money doesn’t have to be complicated or boring. Through playful activities, digital tools, and real-life experiences, children can learn the value of money in a natural and engaging way. By making financial literacy a fun and ongoing conversation, parents can equip their kids with the skills needed to make smart financial decisions. The earlier they start, the better prepared they will be for a financially responsible life ahead.